Webinar Trailer Inhouse banking with virtual accounts YouTube

An in-house bank (IHB) is a structure within an organization where a specific entity takes on centralized management of treasury functions, such as cash management, liquidity and risk. Let's look at a few key functions of an in-house bank and how some similar steps could help your organization. Treasury owns corporate cash

Top 5 benefits of an Inhouse Bank (IHB)

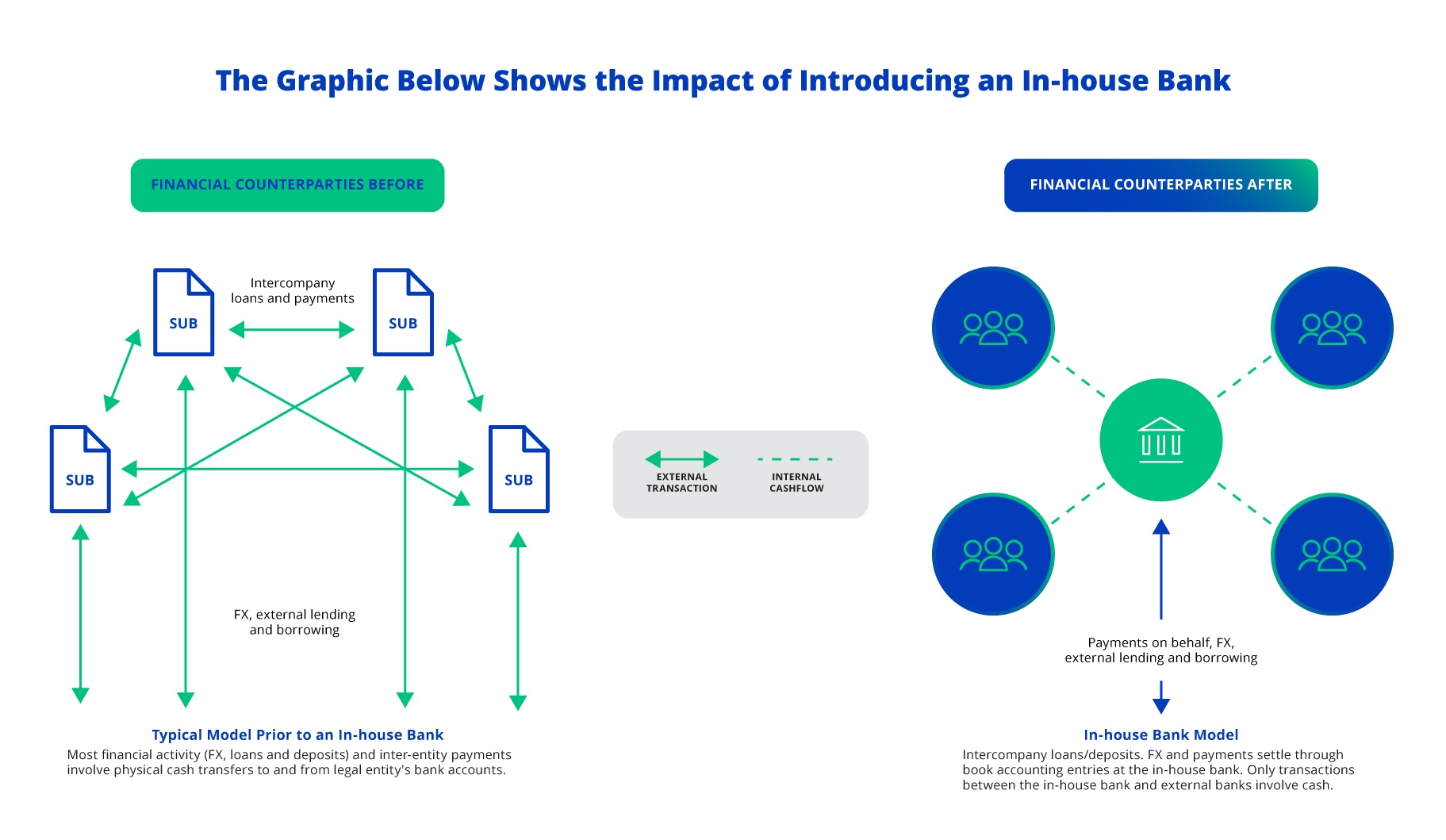

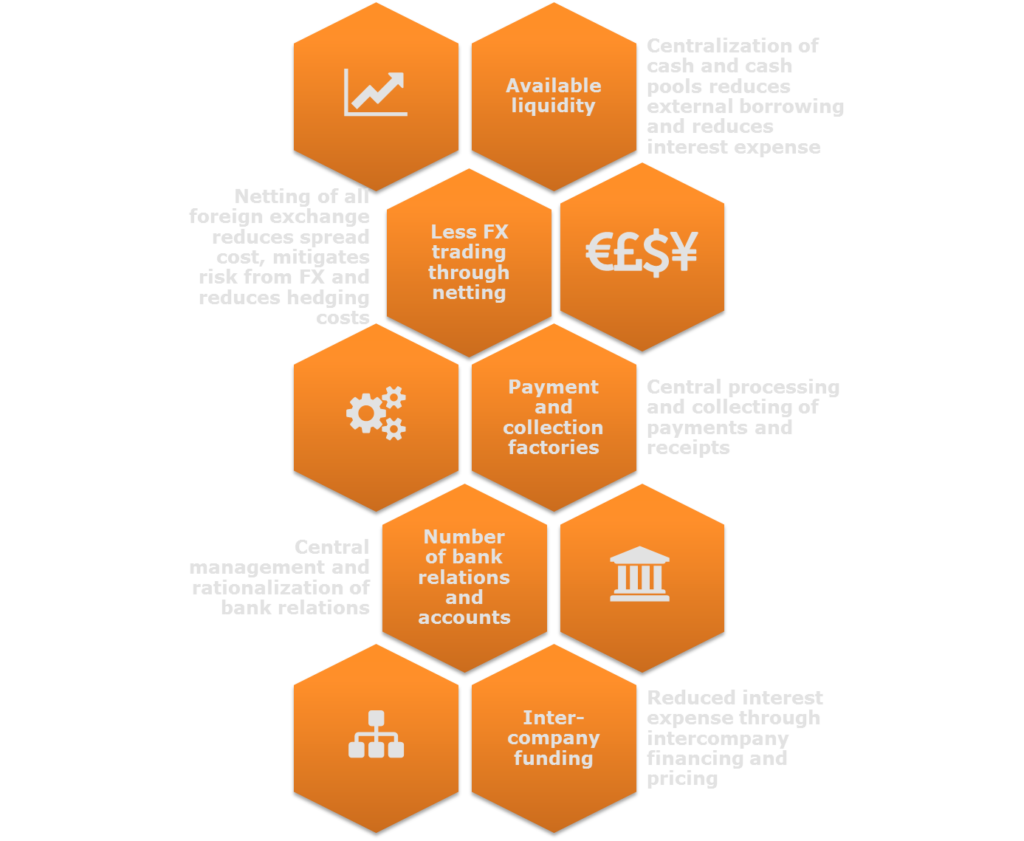

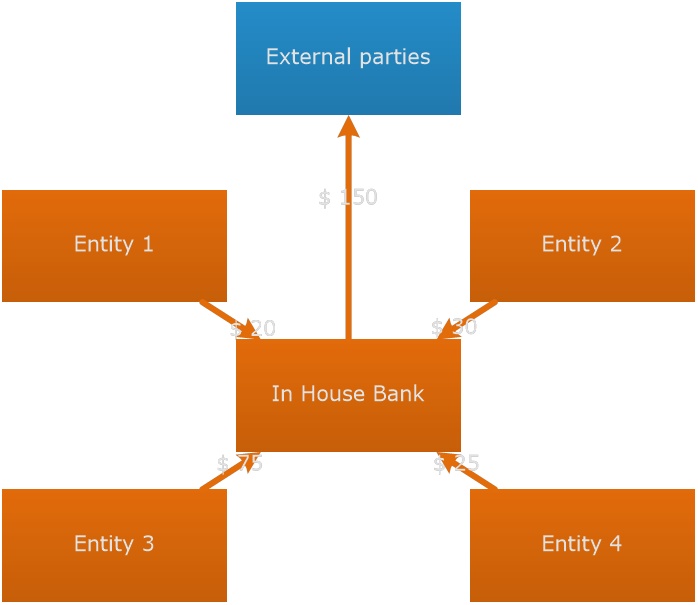

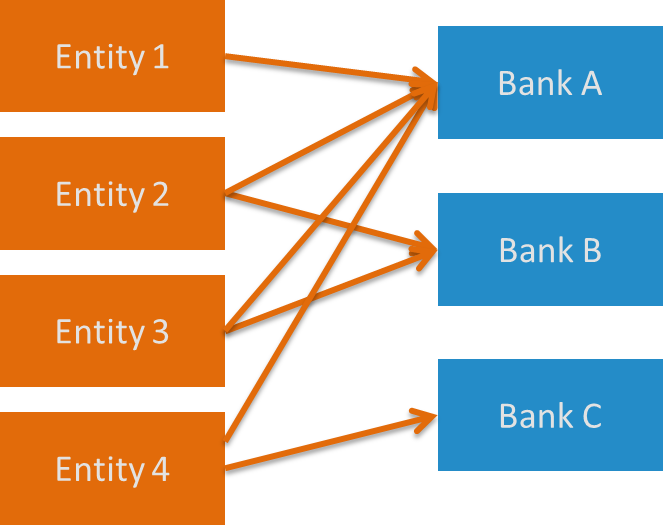

Using your company's own resources for financing, an in-house bank (IHB) is a cost-effective way of consolidating your treasury functions — such as funding, FX and cash management — into one central entity rather than having each subsidiary work through a different local bank.

Solutions by use case Inhouse banking Datalog Finance

For many treasurers, creating an in-house bank is an intimidating prospect. But with robust planning, a clear phased approach, and some suitable technology from an experienced partner, it can be easier than you may think, says Jouni Kirjola, Head of Solutions, Nomentia. Corporates that have set up an in-house bank (IHB) often discover greater.

Cómo y por qué usar el homebanking Buenas Inversiones

Published: Jul 2023. Sélim Ul Hasan. Solvay set up an in-house bank (IHB) to optimise cash management and liquidity availability, reduce operating costs - both internal and external - and improve risk management across FX, counterparty risk and compliance. Our current IHB landscape is the result of several iterations over the past four.

In house banking Deloitte México

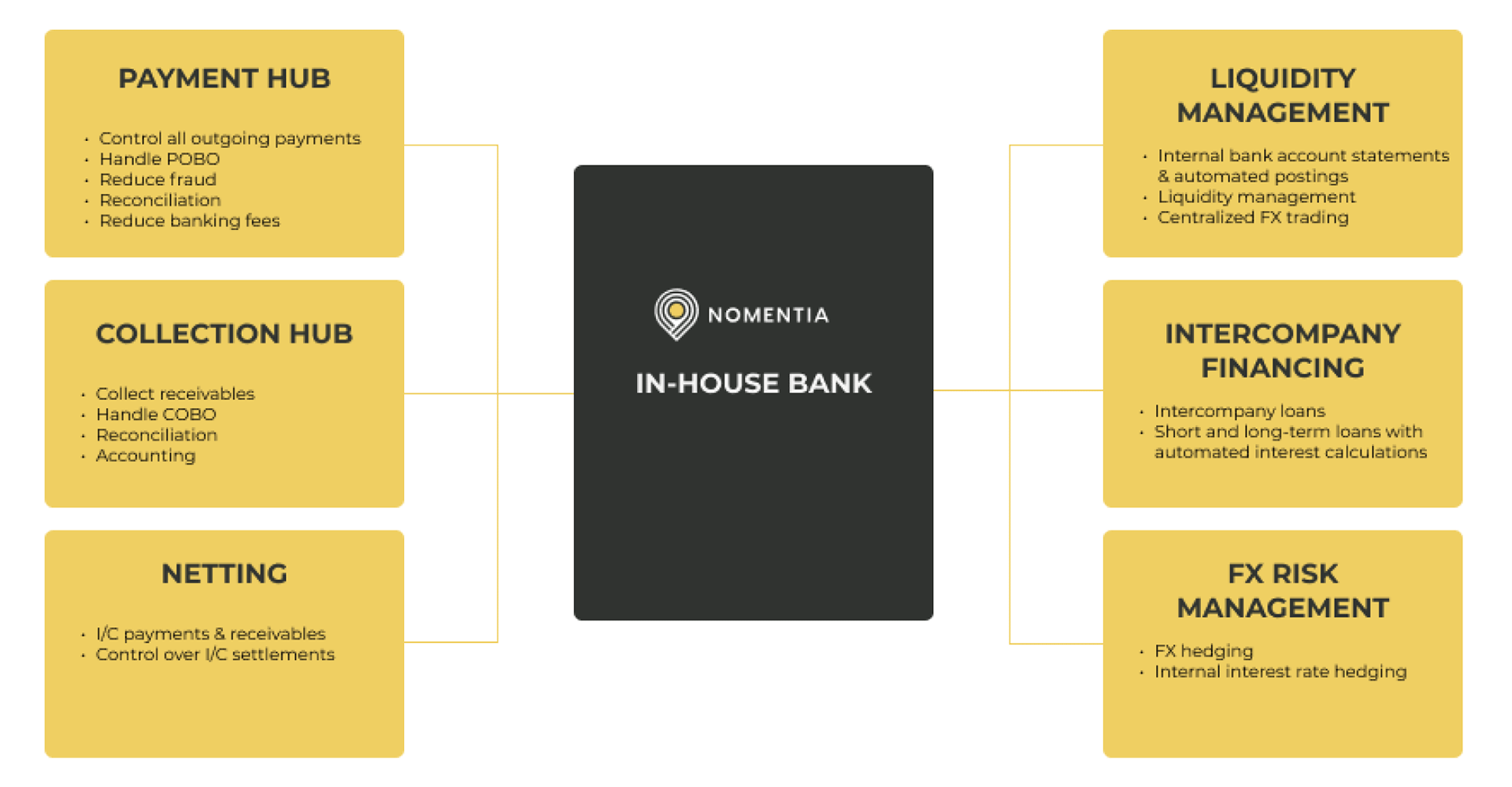

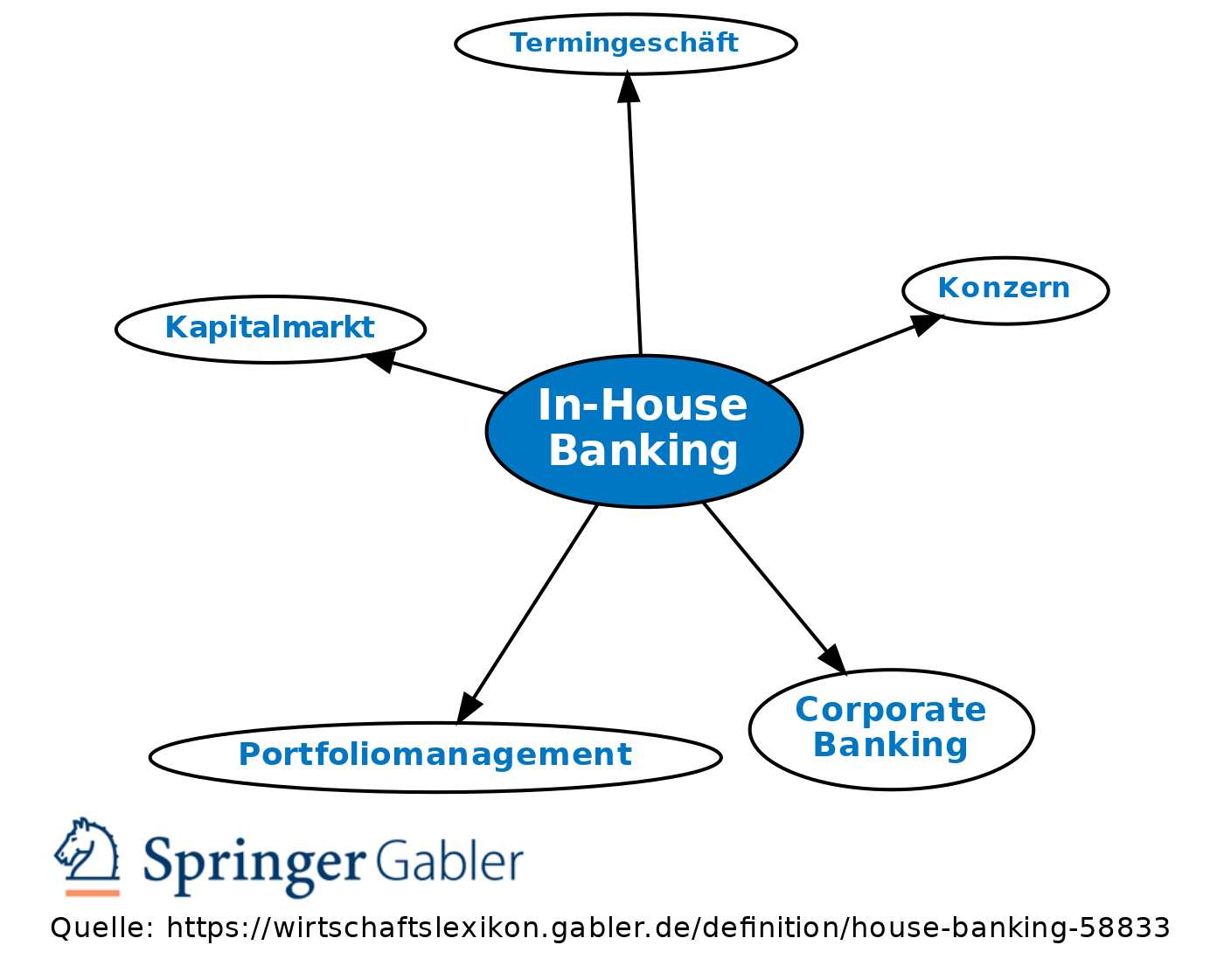

The in-house bank replicates the services that are typically provided by banks. The in-house bank offers solutions for payments, liquidity management and cash visibility, payments on behalf (POBO), collections on behalf (COBO), FX requests, funding, and working capital to business units.

¿Qué es el In House Bank? Beneficios y Riesgos Blog Tesorería

09 Nov 2022 - updated on 16 May 2023 Reading time: 4 min. In-house banking is becoming increasingly popular among corporations and companies that operate multinationally. It simplifies processes and helps minimise costs. Here we show you how in-house banking works, what the benefits of it are and how companies use it efficiently.

In House Bank (IHB) The workings Treasury Improvement

In-house banking directly contributes to a reduction in the risk of fraud and improvements in cybersecurity. Group entities reduce their external interactions and delegate responsibilities to the company conducting the in-house banking. The operational risk associated with workflow management is concentrated and opportunities for fraud are.

Building an InHouse Bank Treasury Management International

What is an in-house bank? An in-house bank is a centralized bank that is specifically set up for your organization for centralized, transparent group-level cash management. An in-house bank (also referred to as IHB) provides the following cash management features: Payment hub Manage all internal payments through an in-house bank.

In House Bank Treasury Corporate Treasury GTreasury

In-house banks are most commonly used by large, multinational companies that have complex external bank account relationship structures, large numbers of affiliates within the enterprise, and substantial volumes of both vendor payments and intercompany invoices.

5 Steps to Successful Build an Inhouse Bank

"An in-house bank can be many things—at one end of the scale, a bank that every subsidiary has to deal with for every transaction, or at the other, an attempt to improve visibility of global cash, exposures and treasury activity while still leaving some autonomy with local entities for local arrangements," said Miranda Hall, director, internatio.

In house Banking A Centralized Treasury Model for Corporates

Oct. 5, 2021 6:10 PM PT. After a long hiatus, the movement to establish a public bank in Los Angeles is once again inching forward. The City Council voted Tuesday to begin a process to study the.

In House Bank (IHB) The workings Treasury Improvement

An in-house bank allows you to lay the foundations for transparent group-level cash management. You can also take care of a variety of other finance and treasury functions centrally, such as banking relationship management, currency risk management, payment and collection management, and internal lending. At the basic level, an in-house bank.

In House Bank (IHB) The workings Treasury Improvement

SAP In-House Banking is the new innovation, an internal banking solution, where subsidiaries can maintain in-house bank accounts with headquarters, available from this year, with SAP S/4HANA Cloud 2208 release. It works with both SAP S/4HANA Cloud and on premise with advanced payment management.

What’s New for InHouse Banking with SAP S/4HANA Cloud, Public Edition 2302 Release SAP Blogs

Top 5 benefits of an In-house Bank (IHB) What is an in-house bank? Why should it be introduced to global organizations? How to implement it? What services can it provide? Find answers in this ebook. What is an in-house bank? Why should it be introduced to global organizations? How to implement it? What services can it provide?

In House Bank (IHB) The workings Treasury Improvement

In-house banks (IHBs) and virtual accounts are powerful tools in the treasury space that have historically been more popular outside the U.S. Yet, both of these solutions present opportunities to U.S. treasurers, and form a potent combination that can create big advantages for organizations.

InHouse Banking • Definition Gabler Banklexikon

What is In House Banking? In simple terms, in-house banking offers an internal or virtual account structure to the group entities, which hold the pulse to replicate the services of the external bank facility.