Learn About Tweezer Candlestick Patterns Today ThinkMarkets

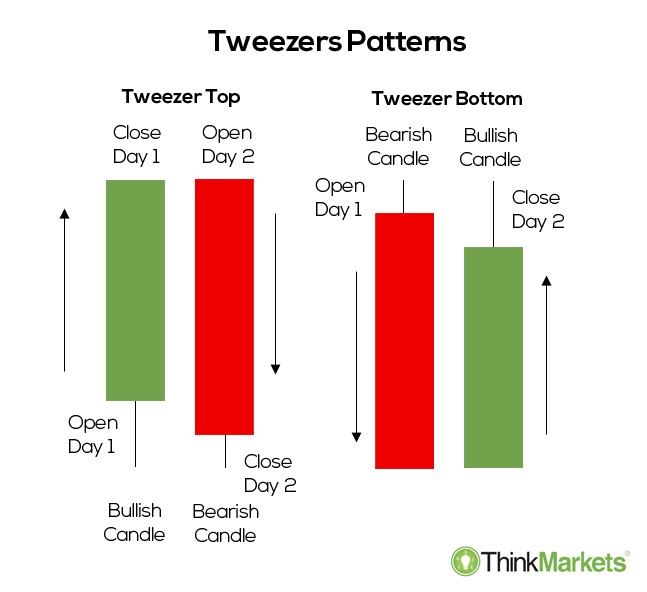

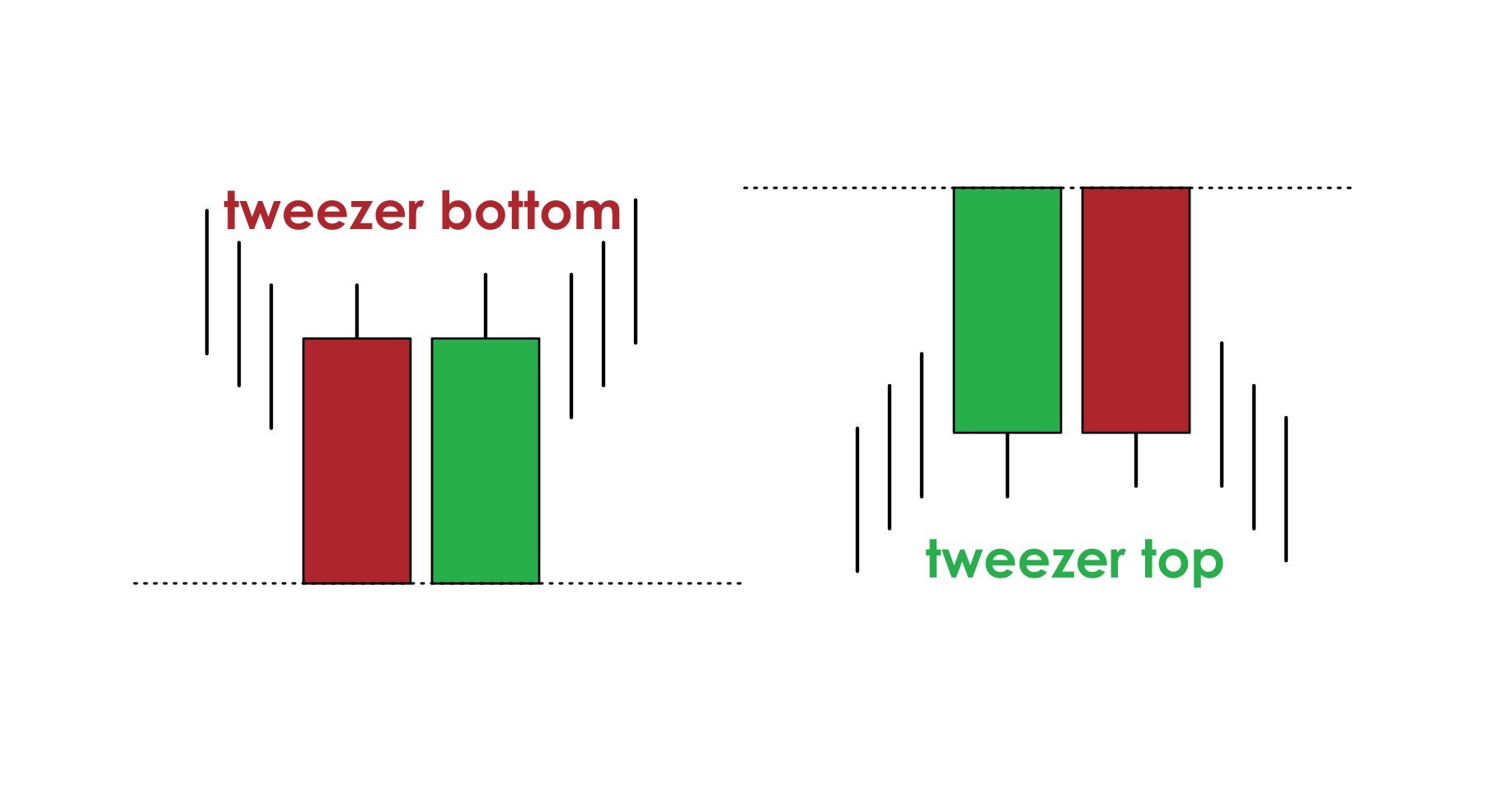

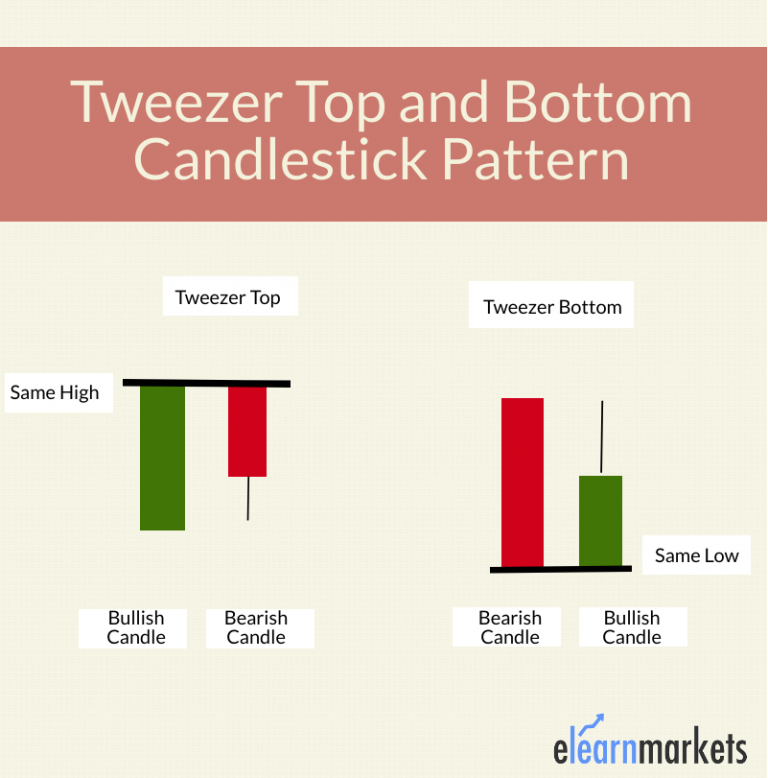

The Tweezer Top formation is viewed as a bearish reversal pattern is seen at the top of uptrends and the Tweezer Bottom formation is viewed as a bullish reversal pattern seen at the bottom of downtrends. Tweezer Top formation consists of two candlesticks: Bullish Candle (Day 1) Bearish Candle (Day 2)

How to Interpret the Tweezer Candlestick Pattern • TradeSmart University

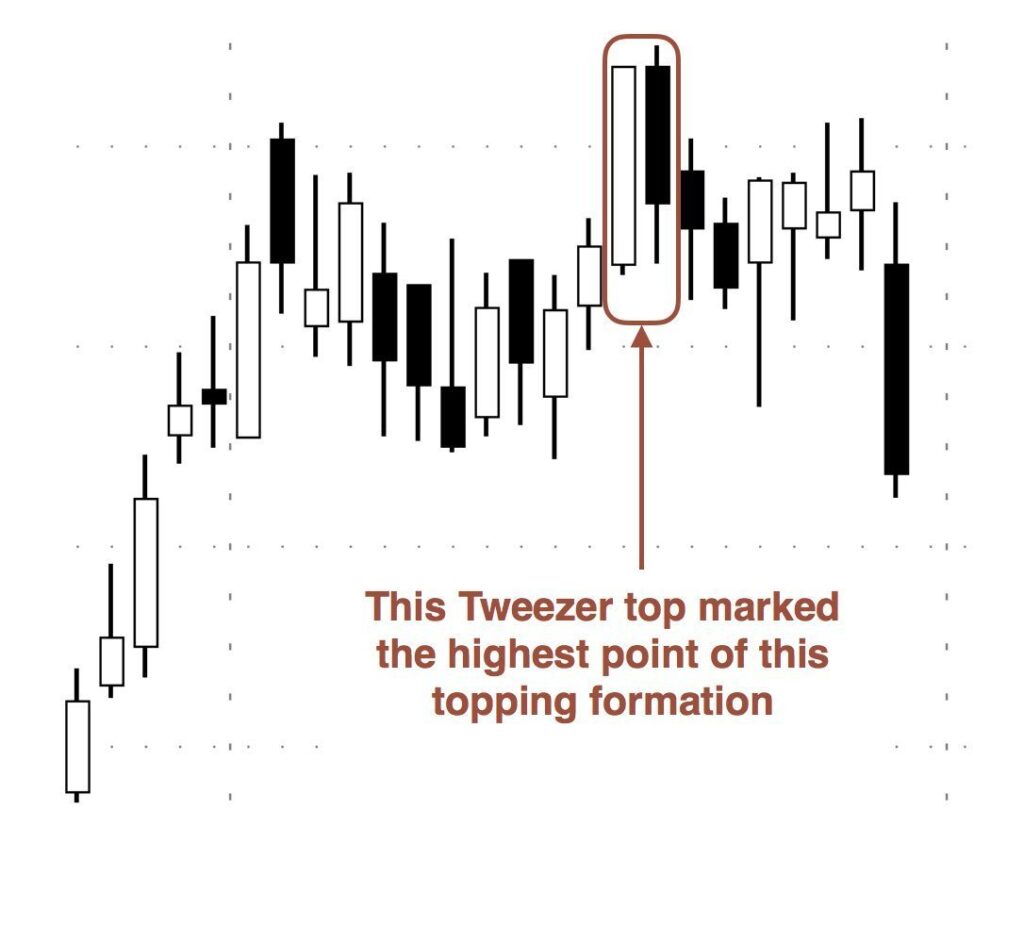

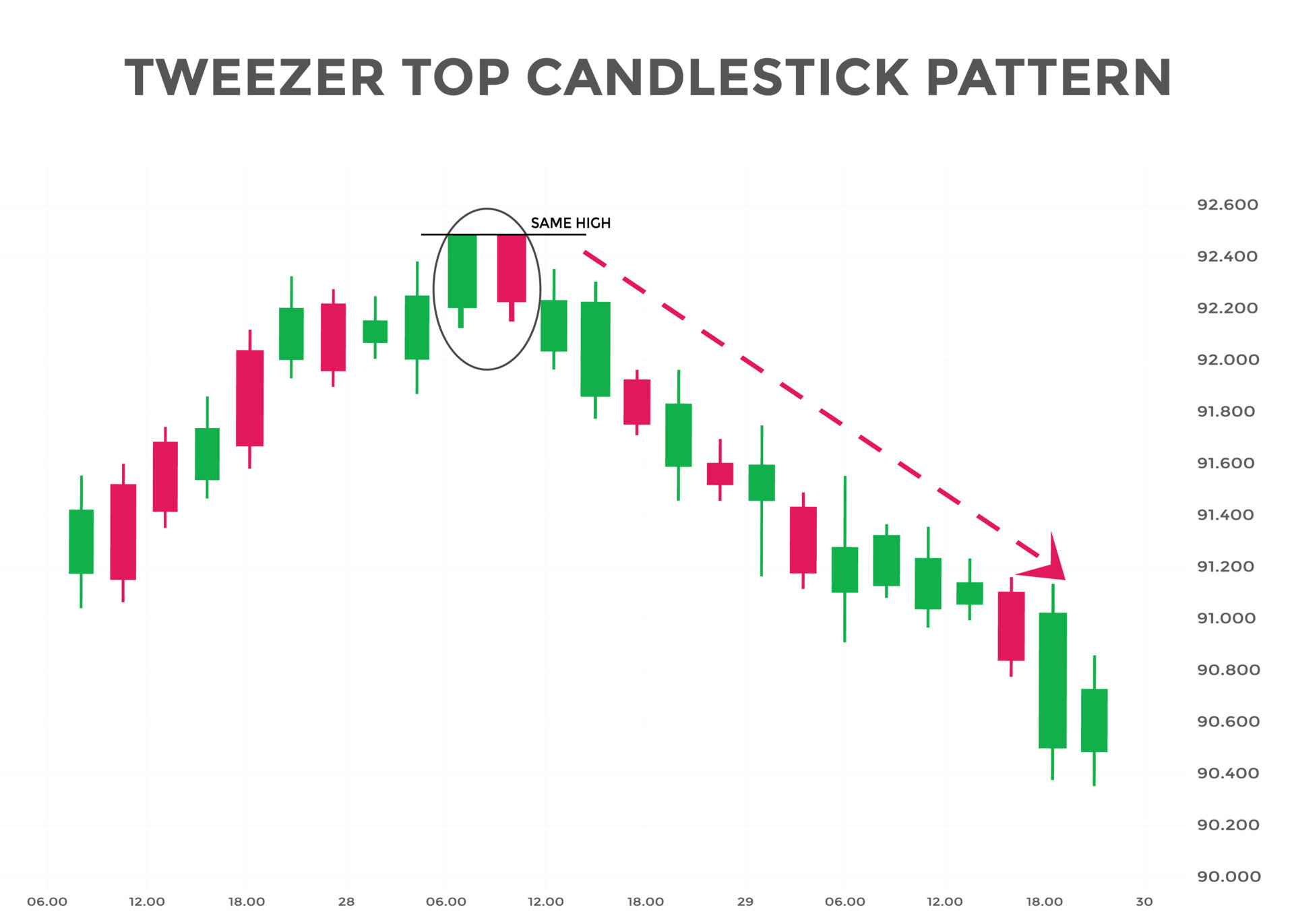

A tweezer top pattern consists of two candlesticks that form two peaks or resistance levels that are equal in height. Typically, when the second candle forms, it can't break above the first candle and causes a tweezer top failure. Tweezer top patterns are two candlestick patterns. A tweezer top occurs after the price has been moving up.

Tweezer Top Pattern A Guide To Trading The Technical Analysis Pattern

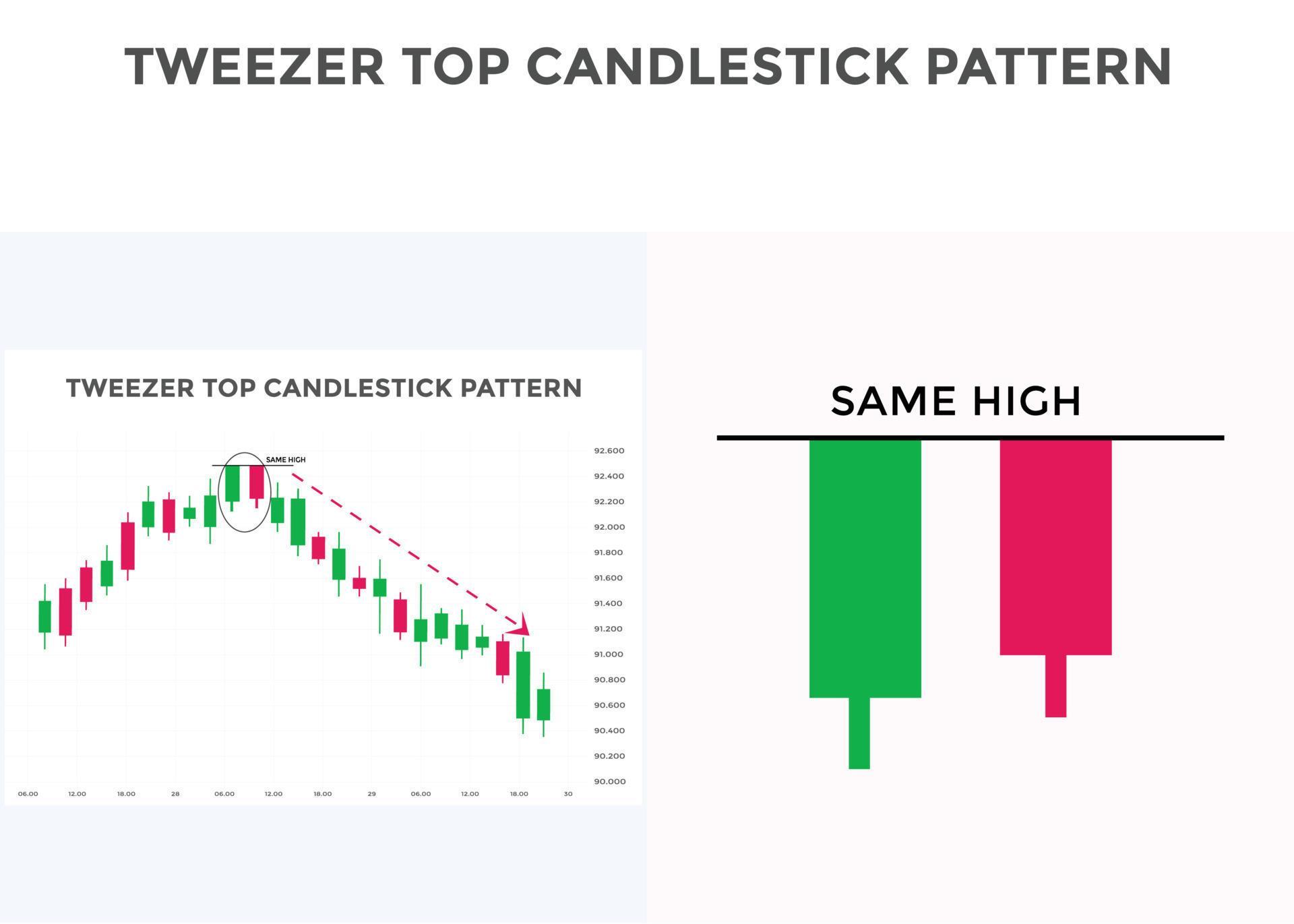

For example, in a tweezers top, the first candlestick may be a strong-up candle, closing near the high. On the other hand, the second candle may be a Doji —a cross-shaped, neutral candlestick.

Tweezer Top Bearish — TradingView

The tweezer top is a two candle bearish reversal pattern that occurs after an uptrend, and signals an imminent reversal of the trend to the downside. The pattern consists of two candles, where the first candle is bullish, and followed by a bearish or bullish candle that has the same high as the previous bar.

Tweezer top candlestick chart pattern. Japanese candlesticks pattern

The tweezer top pattern is a candlestick pattern that every trader should have in their toolbox. It consists of two candlesticks, both with equal highs - one arriving after the other. Now, these candles can come in all shapes and sizes… The crucial thing is that the two highs of the candles are the same. Let me show you…

How To Trade Blog What Are Tweezer Tops And Tweezer Bottoms? Meaning

The first candle of the tweezer top pattern is bullish and opens at $50. However, during the trading session, sellers enter the market, pushing the price down. The second candle opens near $50 and closes below the low of the previous candle, indicating a potential reversal. Traders who identify this pattern may interpret it as a signal to sell.

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

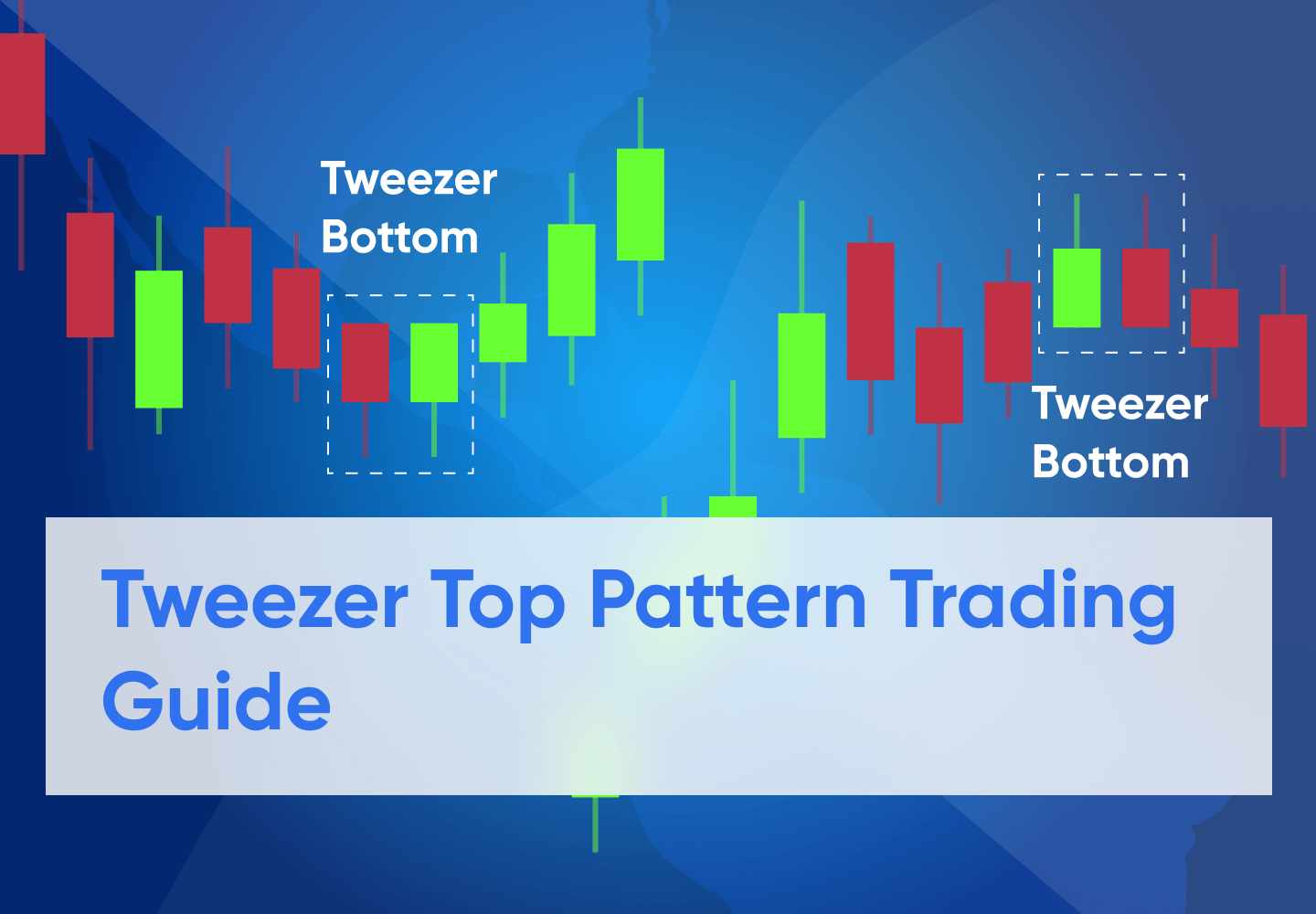

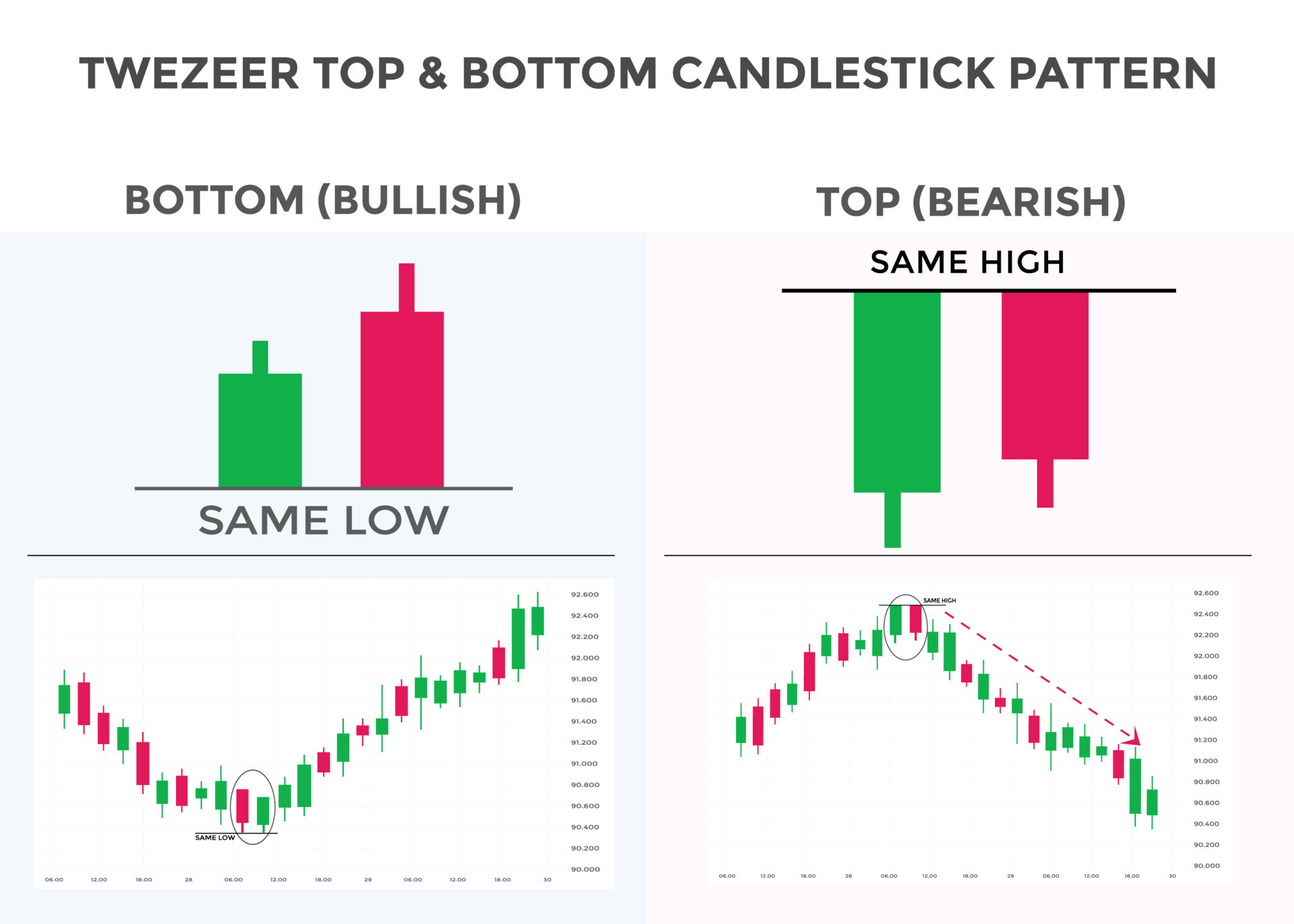

Tweezer Top and Bottom candlestick is a trend reversal pattern that involves two candlesticksTweezer top candlestick indicates a bearish reversal, whereas Tweezer bottom indicates a bullish reversal. When the traders see the formation of tweezer candlestick patterns on the charts, they should be cautious that reversal is going to place.

Tweezer Tops and Bottoms A Trader's Guide TrendSpider Learning Center

A tweezer top pattern is a candlestick pattern that occurs when the highs of two consecutive candlesticks are almost identical, following an uptrend. The pattern is considered a bearish signal, as it indicates the possibility of a trend reversal from bullish to bearish. The tweezer top pattern consists of two candles:

Berbagai Bentuk Candlestick, Lengkap Dengan Gambar! Pelatihan Profit

Example of Tweezer Top Candlestick Pattern. Let's delve into the working of the tweezer top candlestick with an example: Suppose company ABC opened at Rs.250, and as the day progresses, it rises upwards. The day's high was Rs.325, and it eventually closed at Rs.298. The second day also opened on a positive note, and the stock reached a high.

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

The tweezer top candlestick pattern is defined as a bearish reversal pattern featuring two candlesticks. It begins with a green candlestick, which appears on the first day when a stock is witnessing an uptrend. The second day also opens high, making an almost similar high as the first one. Criteria to identify tweezer tops. Three factors help.

Tweezer top candlestick chart pattern. Japanese candlesticks pattern

Our AI Scanned Tweezers For Top Ratings & Lowest Prices. Free Shipping. See Our Top 10 AI Picks for 2023. Find The Best Reviewed Tweezers.

Learn About Tweezer Candlestick Patterns Today ThinkMarkets

Tweezer strategies are popularly used in forex, as well as options and futures trading. How to Identify the Tweezer Top Chart. For a chart to satisfy a tweezer top pattern the following must hold. Two adjacent candlesticks where one or both touch a new recent high; The first bar is a white and is followed by a black

Tweezer top candlestick chart pattern. Japanese candlesticks pattern

A Tweezer Top is a bearish reversal pattern that occurs after an uptrend. It consists of two candles: the first is bullish, and the second is bearish, both having similar highs. A Tweezer Bottom, on the other hand, is a bullish reversal pattern that appears after a downtrend.

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

The Tweezer Top candlestick pattern is unique in that it only requires that the two (or more) candles involved have the same high point. Beyond that trait, the candles can look quite different. This distinguishing feature means that the Tweezer Top candlestick pattern will appear in a different form nearly every time you see it.

What are Top & Bottom Tweezer Candlestick Explained ELM

Join the winning team. Sign Up with Switch Markets: Get HowToTrade for free. Learn More How to Identify the Tweezer Top Pattern in Trading? The tweezer top formation is a user-friendly, intuitive trading signal. The pattern appears amid a formidable uptrend and suggests a price-action reversal.

Tweezer Top TradeCZ

A tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. Tweezer bottoms are considered to be short-term bullish.